The Rise and Rise of Open Banking

By Fiona Couper on Wednesday, 28 October 2020

We recently hosted a webinar in conjunction with the Financial Services Forum (FSF) on ‘FinTechs: The rise and rise of open banking’. With Covid-19 having fast-tracked open banking adoption, and as consumers seek to aggregate accounts and gain insight into their financial health, Juniper Research has predicted that open banking adoption is expected to reach 40m by 2021, up from 18m in 2019. This growth is being driven by Europe, where the regulator-led approach to open banking has created a standardised market, with low barriers to entry – unlike markets such as the US.

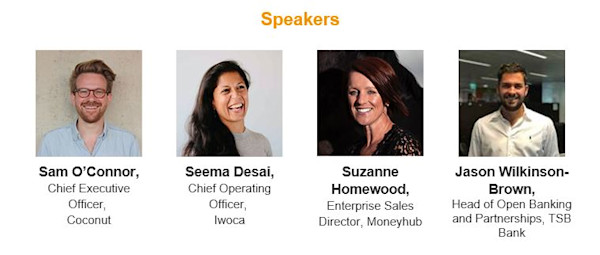

We were delighted host a panel that represents some of the best examples of open banking in our lives today, discussing what it currently allows and the innovative services that are in store.

- Sam O’Connor, CEO Coconut

- Seema Desai, COO Iwoca

- Suzanne Homewood, Enterprise Sales Director, Moneyhub

- Jason Wilkinson-Brown, Head of Open Banking & Partnerships at TSB

Discussion started with the rise of open banking usage as a result of Covid-19, highlighting an increase from 1m to 2m accounts being opened and how the mobile user journey is now smoother than the web equivalent. Suzanne from Moneyhub said that their users are using their app around 7 times a day as well as high demand for their credit check app.

Now that some of the barriers have gone and there’s more confidence in using open banking, the panel highlighted that a greater line of sight across transactional history now allows for a more dynamic adjustment for credit facilities for those who are struggling to repay. Equally, Charities who have suffered hugely during the pandemic due to lack of cash being used now have the ability to provide QR codes on a charity bucket to help address this challenge.

Conversation moved on to discuss the ability for open banking to help the FS sector build back better and whether responsibility was baked in or needed to be added. Jason from TSB stated that trust has to be at the core and that ‘bad actors’ need to be kept at bay. He sees a massive role for the regulator and to not overly burdening SMEs with reauthorisation every three months. Protection for customers and agreement over where liability sits needs to be prioritised, with a focus on dispute management systems so that customers are always able to have a positive experience. For Seema, trust was about understanding the value exchange and keeping that at the centre of all behaviour.

Finally, we explored what the FS ecosystem powered by open banking may be like in five years time and asked if some of the larger tech companies such as Amazon or Google could eat our lunches. Whilst almost impossible to predict, Seema felt that being able to make payments through Alexa was highly likely. Jason flagged that Amazon’s AWS platform already exists and the direction of travel is towards becoming an aggregator for consumers with multiple options available, but questioned whether their size could be a hindrance. But premium APIs that facilitate proof of age for buying alcohol or faster passport checks would be welcome. For Sam, the ability to include transactional data would help ensure those targeted ads for trainers stopped once you had bought a pair.

We concluded that the UK is in a fortunate position with a favourable regulator and a Government who has been supportive (quote of the day from Seema) in terms of financing innovation within FinTech. Many thanks as always to our panel for their generosity of insight.

View the entire webinar here:

The questions we covered were:

If open banking is at the heart of the opportunity to build back better, do you think open banking has responsibility baked in, and if not, what needs to happen?

Where’s the predicted doubling of adoption rates by 2021 leading to? In five years time, are we going to have a handful of leading providers offering all FS services through open banking partnerships – and are the tech giants such as Amazon about to march in and eat all our lunches?

What sort of product innovation are we going to start seeing now that some of the barriers have gone and there’s more confidence in using open banking? And will the £15bn gap in growth capital hinder these innovations?